Market activity (2020-2021)

We focus on healthy and workable competition for buying and selling domain names in the .nz domain namespace. We report on the retail price consumers are paying for their .nz domain name. This year, we created an interactive dashboard about key domain name statistics.

Market highlights

.nz market in 2020/2021 was marked by processes of concentration, bulk transfers between entities, intensification of competition for .nz ccTLD management contracts and exits from the .nz market.

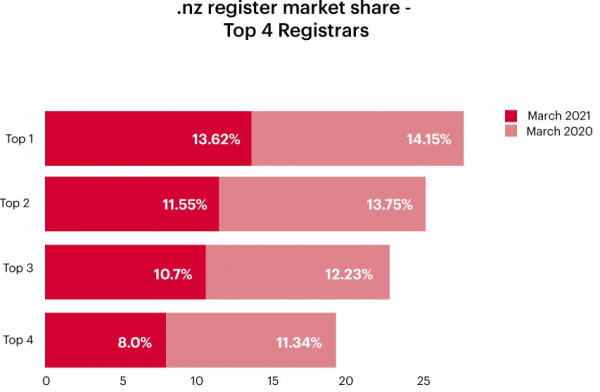

In March 2020, the top four registrars had 43.87% of the market, which was split quite evenly across those four.

In March 2021, the top four registrars' percentage ownership of the market rose to 51.47%, which remained split quite evenly across those four. These figures treat each registrar brand separately and do not aggregate where there is common ultimate ownership.

Five registrars joined the market this year, providing a steady number of new entrants. We had more New Zealand based registrars join than the previous year.

17 authorised registrars exited the market, including many small providers (less than 1500 domain names under management), telecommunications and internet service providers.

The Commission also took the step of requiring trading names to be listed in the .nz query service (WHOIS) for registrars using a different legal name to their trading name. It has been applied to all new authorisations and mergers and acquisitions. Legacy registrars will also be requested to do this in 2021/2022.

Key market statistics

In 2020/2021, in the .nz domain namespace:

- The rate of new .nz domain names being created averaged about 10,300 per month.

- The net growth for the year was 2%.

We saw uncharacteristic surges in new creates in April, May and June 2020, which appears to have been in response to COVID-19 and more people and businesses getting online.

We saw typical seasonal patterns with registration dips in domains created in October.

Advertised primary retail market prices

In 2020/2021, the Commission started using a web crawler to collect advertised primary retail market price ranges from the top registrars and published the retail price on our website. It is in addition to our twice a year whole of market retail price capture exercise.

The retail median pricing for .co.nz excluding tax has been relatively stable since 2017:

Retail market price

December

$36.20

June

$36.00

December

$36.00

The retail median pricing for .co.nz has decreased slightly this financial year. It is important, as it implies the recent demand in domains is unlikely explained by price discounting, and the increase in the wholesale price for demand does not appear to have materially impacted the retail price.

Market concentration

Consolidation in the Top 10 registrars accelerated this year. Most notably, there were changes in control at the Free Parking Group of companies and WebCentral Group Ltd and acquisition of the TPP wholesale and associated trading companies. This trend has been intensifying these past two years. This is likely to continue for the foreseeable future.

Deeper market insights planned for 2021/2022

For many registrars who have not grown to achieve substantial economies of scale or kept up with changes happening at the registry level, concentration or exit is a real possibility.

In this regard for 2021/2022, with the help of the Assistant Domain Name Commissioner and an economist, we will internally re-examine the factors affecting competition and our healthy market measures.

Healthy market measures

The Commission continues to work on its definition of .nz market health. We are mindful of conditions for those in the middle of the market. In the meantime, we continue to use a number of measures to consider the overall health of a well-functioning market.

Figure 1: Various healthy market measures

|

High-level result sought |

How we track result |

Target |

Result |

|

Overall improvement of statistics on domain name market and pricing |

Measures across retail pricing, creates and transfers were added to the DNC website |

Overall improvement in suite of competition statistics and health of the market |

Achieved. There was a continued improvement in the suite of competition statistics during 2020/2021 and publication on the DNC website. |

|

New registrar entrants |

New entrants entering the market |

5 new entrants per year |

Achieved. In 2020/2021 there were 5 new entrants to the market. |

|

Exits awareness |

Tracking registrars leaving the market. |

Having data on exit behaviour. |

Achieved. In 2020/21 there were 17 exits. |

|

Mergers |

Enforcement of change in control contractual terms |

Due diligence performed on any mergers |

In 2020/2021 reviews of 7 change of control applicants were processed. |

|

Average retail price of a .nz domain |

Publish prices on our website over time |

At least twice a year |

In 2020/2021 the Commission started the collection of monthly retail pricing data and has published that to our market data home on our website. |

|

Market concentration |

HHI index |

Monitor concentration levels among the top of the market |

In 2020/21 the HHI rose from 554 (March 2020) to 803 (March 2021). This increase in market concentration has prompted us to internally review our competition metrics in 2021/2022. |

|

Renewal rate |

Reporting |

Capture domain name renewal rates for each registrar |

In 2020/2021 the renewal rates remained steady with registrations of long duration trending slightly upwards. |

Case study: retention rates

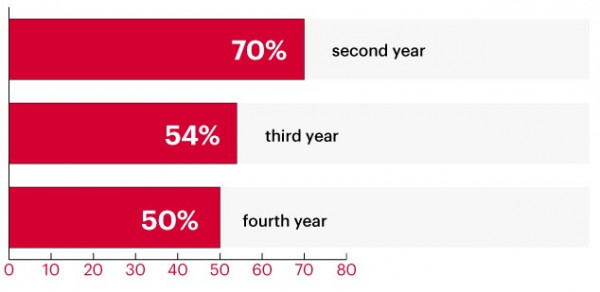

Retention of domain names into a second year stands at around 70%. Domain name retention drops off over time with retention of a domain name into a third year standing at around 54% and into a fourth year standing at around 50%.

Domain name usage

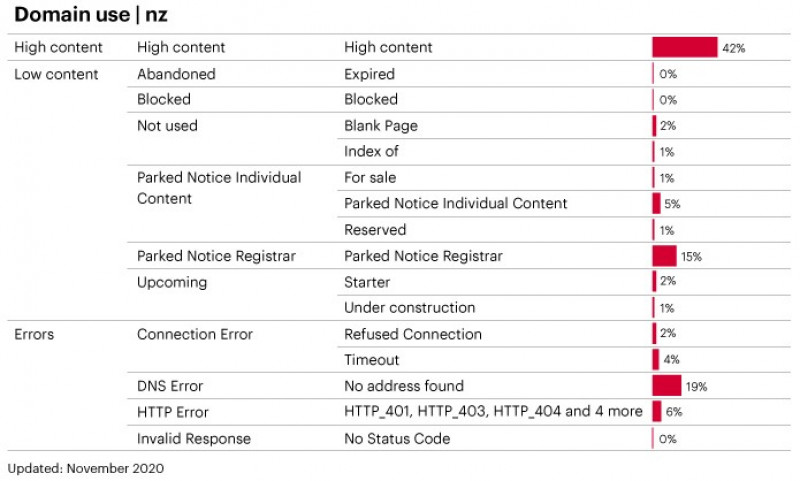

The Commission has been using a low content taxonomy model built by the InternetNZ Research team to monitor domain name usage within the .nz domain namespace.

The data shows that there is a high content associated with .nz domain names. High use indicates registrants are investing in their online presence in this space, recognising there is value in operating in the .nz domain namespace.

Methodology: 50K random sample of the selected TLDs is taken. Domains are run through the crawler being classified according to the above hierarchy. If a domain from the sample is redirected, the final url is the one that is classified.

More information about the model is available at: Detection of .nz domains with low content website